When you hear the word “budget,” do you instantly think of sacrifice or math headaches? That reaction is common, but budgeting doesn’t have to be overwhelming or restrictive. In reality, a budget is simply a plan for your money—a way to give every dollar a job and make your financial goals achievable.

Think of budgeting as a tool that helps you spend on what matters most, save for the future, and finally stop stressing about money. In this beginner-friendly guide, we’ll walk through 7 simple steps to create a budget that actually works for your life (no finance degree required!).

Why Budgeting Matters (And Why Most People Fail at It)

Before diving into the steps, let’s clear up a huge misconception:

👉 A budget isn’t about deprivation—it’s about control.

Here’s why it matters:

- 65% of Americans don’t know how much they spent last month.

- Only 41% actively follow a budget—yet those who do report being less stressed about money.

- Most people admit they don’t have a clear savings plan, which makes it harder to reach long-term goals.

- Without a budget, it’s easy to overspend and rely on credit cards, leading to debt.

- Budgeting builds confidence and reduces financial anxiety by giving you a clear roadmap.

So why do most budgets fail?

- They’re too rigid (people quit when they feel trapped).

- They’re too time-consuming (if it takes hours every week, it won’t last).

The solution is simple: start small, keep it flexible, and focus on progress—not perfection.

Step 1: Calculate Your Monthly Income

Your budget starts with knowing how much money you actually bring in each month. Without a clear picture of your income, it’s impossible to build a realistic spending plan. This step helps you set a foundation and prevents you from accidentally budgeting with money you don’t consistently have. Once you know your true monthly income, the rest of the process becomes much easier.

What to include:

✅ Take-home pay (after taxes)

✅ Side hustle or freelance income

✅ Consistent bonuses or tips

What to leave out:

❌ One-time windfalls (like birthday gifts or lottery wins)

❌ Highly unpredictable income

Example:

- Salary: $3,500

- Freelance work: $300

- Total monthly income: $3,800

💡 Pro Tip: If your income varies, budget using the average of the last 3 months or base it on your lowest-earning month for safety.

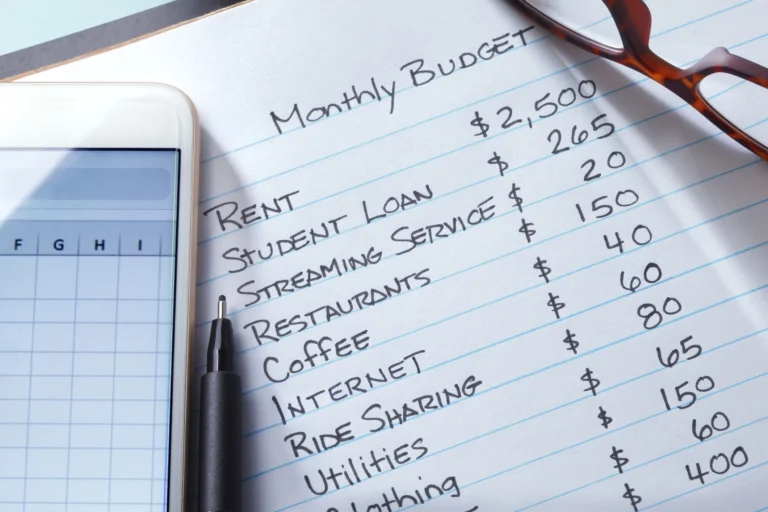

Step 2: Track Your Spending (The Eye-Opener!)

Before you can cut back, you need to know where your money is going. Tracking your spending shines a light on habits you may not even realize you have. It helps you see whether your money is going toward things that align with your goals—or being drained by impulse buys and hidden expenses. Even tracking for just one month can completely change how you view your finances.

How to track:

- Old-school notebook and pen

- Spreadsheet (Google Sheets or Excel)

- Budgeting apps like YNAB (You Need a Budget) or PocketGuard

Common money leaks to watch for:

☕ Daily coffee runs or takeout

📱 Forgotten subscriptions you don’t use

🛒 Emotional “treat yourself” purchases

You might be shocked at how much those “small” expenses add up!

Step 3: Categorize Your Expenses

Once you’ve tracked your spending, it’s time to make sense of it. Categorizing your expenses helps you clearly see which costs are essential and which are optional. This simple step makes it easier to spot areas where you can cut back without drastically changing your lifestyle. By organizing your expenses, you’ll gain insight into how to balance your financial priorities.

| Category | Examples | Traits |

|---|---|---|

| Fixed Expenses | Rent, insurance, car payments | Priority payments, rarely change |

| Variable Expenses | Groceries, gas, utilities | Fluctuate month to month |

| Discretionary | Dining out, streaming, hobbies | Wants—easiest to cut |

💡 Why this works: When money is tight, you’ll immediately know which categories to trim without affecting your essentials.

Step 4: Set Realistic Financial Goals

A budget without goals is just a spreadsheet. Setting goals gives your money direction and ensures your spending habits align with what you truly value. Whether it’s building savings, paying off debt, or freeing up cash for travel, your goals will shape how you allocate your money. Keep them realistic so you can actually stick with them—and celebrate progress along the way.

Ask yourself:

- Do I want to build an emergency fund?

- Am I focused on paying off debt?

- Do I want to save for vacations, homeownership, or retirement?

Example goals for beginners:

- Save $1,000 in an emergency fund

- Pay off $2,000 in credit card debt

- Cut monthly takeout spending from $250 → $100

✅ Start small. Even saving $50 a month is better than nothing—and it builds momentum.

Step 5: Create Your First Budget

Now the fun part: putting the numbers together. Creating a budget means assigning every dollar a purpose so you’re in control of where it goes. A beginner-friendly framework is the 50/30/20 Rule, which keeps things simple and balanced. This method ensures you’re covering your needs, enjoying your wants, and still making progress toward your financial future.

The 50/30/20 Rule:

- 50% Needs: Rent, groceries, utilities, transportation

- 30% Wants: Eating out, shopping, entertainment

- 20% Savings/Debt: Emergency fund, retirement, debt payoff

Example on a $3,800 income:

- Needs = $1,900

- Wants = $1,140

- Savings/Debt = $760

💡 Too tight? Adjust it! Many families use 60/20/20 if their living costs are higher.

👉 Want more details? Check out our guide: The 50/30/20 Budget Rule: The Easiest Way to Manage Your Money Stress-Free.

Step 6: Automate Your Success

The less you rely on willpower, the easier budgeting becomes. Automation ensures that your savings and bills are taken care of before you even have a chance to overspend. This removes temptation and helps you stay consistent month after month. Think of it as putting your financial progress on autopilot.

Ways to automate:

- Auto-transfer a portion of your paycheck into savings

- Set up automatic bill pay to avoid late fees

- Use apps like Qapital or Acorns to round up purchases and stash the difference

“Automation is the secret weapon of people who are good with money.” – David Bach, financial expert

Think of it as paying your future self first.

Step 7: Review & Adjust (No Guilt Allowed!)

Your budget isn’t carved in stone—it’s a living plan. Checking in regularly helps you catch mistakes, spot overspending, and celebrate wins. Life changes, and your budget should adapt right alongside it. By treating this as an ongoing process instead of a one-time fix, you’ll set yourself up for long-term success.

Quick monthly check-in:

✅ What went well?

✅ Where did I overspend?

✅ What can I improve next month?

Even if you “fail,” you’re learning. Overspent on dining out? That’s not failure—it’s feedback.

💡 Pro Tip: Spend 10 minutes every Sunday checking your progress. Small adjustments keep you on track long-term.

Final Thoughts: Budgeting = Freedom

Budgeting isn’t about cutting out all fun—it’s about creating a clear path to your goals. A good budget gives you clarity, confidence, and control over your money instead of feeling like it controls you. Whether your dream is building an emergency fund, paying off debt, buying a home, or taking that long-awaited trip, budgeting is the tool that makes it possible.

Start with small, manageable steps and let your budget grow with you. The key is progress, not perfection. By taking charge today, you’re not just tracking numbers—you’re building the foundation for financial freedom and a less stressful future.

Frequently Asked Questions (FAQs)

1. How much money should beginners save each month?

A common guideline is to save 20% of your income using the 50/30/20 rule. If that feels out of reach, start with a smaller amount—saving even $25–$50 monthly helps you build the habit.

2. How long does it take to get good at budgeting?

Most beginners need 2–3 months to feel comfortable with budgeting. It may feel awkward at first, but over time, tracking expenses and adjusting your budget will become second nature.

3. What is the best budgeting method for beginners?

The 50/30/20 rule is one of the easiest budgeting methods to start with. It splits your income into 50% needs, 30% wants, and 20% savings or debt repayment, giving you structure without being too rigid.

4. How can I budget if my income is irregular?

If your income changes month to month, use the average of your last three months or budget based on your lowest-earning month. This makes sure you can cover essentials without relying on uncertain income.

5. Do I need a budgeting app, or can I use a spreadsheet?

You don’t need an app to budget successfully. While apps like YNAB and PocketGuard are helpful, many beginners find Google Sheets or Excel just as effective. The key is consistency, not the tool.

6. Can I still spend money on fun things while budgeting?

Yes! A good budget should include discretionary spending. Planning for fun purchases ensures you can enjoy them guilt-free while still working toward your financial goals.

[…] Starting your financial journey can feel overwhelming, but budgeting apps remove the guesswork. Instead of manually tracking receipts or spreadsheets, these tools automatically categorize expenses, show where your money is going, and help you stay on track with savings goals. […]