Debt is like dragging around a heavy backpack — the sooner you lighten the load, the freer you feel. But when you have multiple debts — different balances, different interest rates — deciding which one to tackle first can make a surprisingly big difference in how fast you get out of debt, how much interest you pay, and how likely you are to stick with your plan. Two popular strategies dominate this conversation: the Debt Snowball method and the Debt Avalanche method.

In this article, we’ll walk through:

- What each method is and how it works (step by step)

- The pros, cons, and trade-offs

- What real data and behavioral research tell us

- How to choose the strategy that fits you

- Tips for staying consistent and making progress

Whether you’re staring down credit card balances, student loans, or personal loans, by the end you’ll be equipped to pick (or even combine) a plan that helps you win.

Understanding the Two Methods in Depth

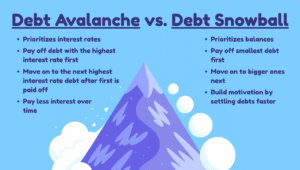

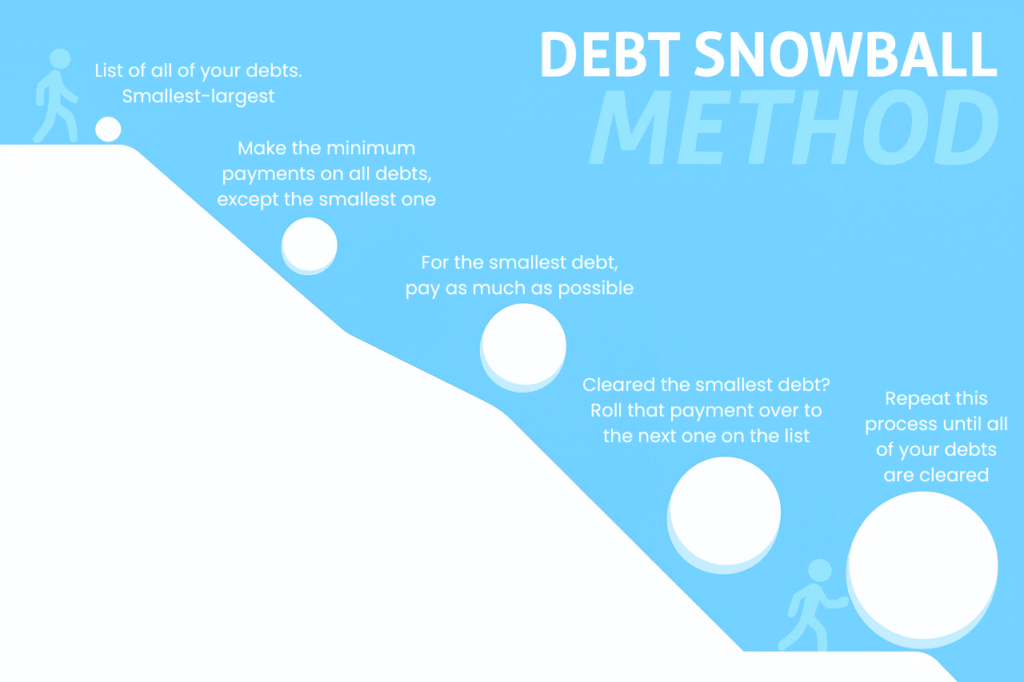

What Is the Debt Snowball Method?

The Debt Snowball method, popularized by Dave Ramsey and many personal finance advocates, is built on the idea of gaining momentum through early wins.

Here’s how it works, step by step:

- List all debts — include credit cards, personal loans, medical bills, etc.

- Order them from smallest balance to largest, ignoring interest rates.

- Pay the minimum on all debts except the smallest one.

- Throw every extra dollar you can toward that smallest debt until it’s paid off.

- Once it’s gone, roll the full payment amount (minimum + extra) into the next smallest debt.

- Continue until every debt is paid.

As each debt disappears, the amount you can throw at the next one “snowballs” — gaining size as you go.

Why this method appeals to many people is simple: early, visible progress. Knocking out a small debt fast gives you emotional satisfaction and proof that you’re making headway, which can fuel motivation to continue.

Behavioral research backs this: one study reported that people who concentrate on one or a few payments at a time (i.e. eliminating small balances first) repaid their debt about 15% faster than those who spread out focus. (holbornassets.com)

Another compelling insight came from Kellogg School researchers, who found that consumers who tackled small balances first were more likely to eliminate their overall debt than those who attacked high-interest balances first. (kellogg.northwestern.edu)

That said, because the method doesn’t prioritize high interest, you may pay more interest over time, and the final debts (often large ones) may drag on.

What Is the Debt Avalanche Method?

The Debt Avalanche method takes a different lens. Instead of chasing quick wins, it attacks the mathematically more expensive debts first — those costing you the most in interest.

Here’s how it works:

- Make minimum payments on all debts to avoid penalties.

- Rank your debts by interest rate, from highest to lowest (regardless of balance).

- Put all extra funds toward the debt with the highest interest rate.

- Once that debt is paid off, redirect the freed-up payment (minimum + extra) toward the debt with the next highest rate.

- Repeat until all debts are gone.

Because you’re tackling the costliest debt first, you reduce the amount of interest being tacked on month after month, which can shorten your time to becoming debt-free and decrease your total interest cost.

For example: suppose you have three debts:

- $10,000 at 18.99% APR

- $9,000 at 3.00% APR

- $15,000 at 4.50% APR

If using the avalanche method, you’d target the 18.99% debt first. In this scenario, doing so saved you roughly $500 in interest compared to the snowball route — even though both paths ended up eliminating all debt in 11 months.

While the avalanche method may require more patience (especially if your highest interest debt is also large), it often yields the most efficient financial path. Many financial institutions and advisors advocate for it as the “optimal” way to pay down debt.

The Trade-Offs: Emotion vs Efficiency

At a high level, the decision between snowball and avalanche is a trade-off between psychological drive and mathematical efficiency. The optimal method is the one you’ll stick with.

Here are the main pros and cons side by side:

| Method | Pros | Cons |

|---|---|---|

| Debt Snowball | Quick wins boost morale; simpler to execute (just sort by balance) | Can cost more in interest and time if large, high-interest debts get delayed |

| Debt Avalanche | Minimizes total interest, often shortest payoff timeline | Might feel slow early on, especially if your top debt is huge — risk of losing motivation |

For many people, the risk of quitting or losing momentum is more costly than the extra interest paid. As one LendingTree analyst put it: there is no absolute right answer — it depends heavily on personal style, finances, and what keeps you motivated.

Additionally, anecdotal studies show that while in many cases the avalanche method edges out snowball in purely mathematical terms, the gap is often modest. People may lean toward snowball if it better fits their psychological wiring.

Another nuance: if your smallest debt also has a high interest rate, then both methods point in the same direction and there’s no conflict.

👉 Ready to crush your credit cards even faster? Head over to 10 Smart Strategies to Pay Off Credit Card Debt Faster for proven tips you can start using today.

What Real-World Numbers Say

Let’s root this discussion in concrete data to guide you.

U.S. Credit Card Debt & Interest Rates

- As of the first quarter of 2025, U.S. outstanding credit card balances hit $1.18 trillion.

- The average credit card interest rate (APR) on accounts with balances assessed interest is 21.91% (Feb 2025).

- The average credit card debt per person was $6,455 in February 2025.

Source: (education.savvymoney.com)

Those are steep numbers. At those rates, paying only minimum amounts often means most of your payment goes to interest rather than principal.

Behavior & Payoff Speed

- A study noted that focusing payments (i.e., the snowball mentality) helped people pay off debts 15% faster compared to spreading payments evenly.(holbornassets.com)

- In a dataset of about 6,000 credit card users (from a debt settlement company), researchers at Kellogg found that those who prioritized small balances were more likely to eliminate all debt than those who prioritized high-interest ones. (kellogg.northwestern.edu)

- That said, some empirical simulation analyses show that in many realistic debt portfolios, avalanche yields slightly lower interest costs, though the difference often isn’t huge.

So in practice: both methods work. The real question is which one helps you persist until the finish line.

How to Choose the Right Strategy for You

You’re not bound to one method forever. But here’s a way to think about this decision:

1. Assess Your Emotional Style and Motivation

- Do you struggle to stay consistent unless you see wins?

Snowball may be the better choice because those small victories early on can build momentum. - Do interest costs deeply bother you, and you can stay disciplined even when progress is slow?

Avalanche might be a better match — knowing you’re minimizing wasted interest may motivate you. - Could a hybrid work?

A common tactic is to start with snowball to get momentum, then switch to avalanche mid-way once you’re motivated. Or prioritize high interest until one small debt is paid, then pivot.

2. Look at Your Debt Profile

- If your highest-interest debt is also a smaller balance, both strategies converge naturally. You’ll be attacking the same debt first regardless of method.

- If your smallest debt is low interest and your largest debt is high interest, then the conflict is stronger, and interest savings may favor avalanche.

- If you carry multiple high-interest debts, the interest savings with avalanche may be more significant.

3. Do the Math (Pro Forma)

You can run a quick scenario: simulate how long it would take each method to pay off your debts and how much interest you’d pay. There are many free online calculators that allow you to input your balances, interest rates, and extra payment amount to compare snowball vs avalanche. (A few banks and financial websites even have built-in comparison tools.)

If the interest difference is small in your case, lean toward the method you’re more likely to stick with. If it’s large, it’s worth pushing through the harder early period.

4. Commit to Consistency

Regardless of the method, the biggest driver of success is consistency. Sticking with a plan, month after month, matters more than having the theoretically perfect algorithm.

A few ways to boost consistency:

- Automate your payments

- Track progress visually (charts, apps, graphs)

- Celebrate small wins

- Revisit your budget frequently to free up more cash

- Consider accountability (partner, coach, friend)

👉 Picking a payoff method is only half the battle — the other half is making sure your budget supports it. A clear, intentional budget gives you the extra dollars to fuel your debt snowball or avalanche. If you need help setting one up, check out our guide: Budgeting for Beginners: 7 Easy Steps to Take Control of Your Money.

Tips and Best Practices (Regardless of Method)

Here are strategies that help enhance success, no matter which method you embrace:

- Consolidate wisely: If you have access to a lower-interest personal loan or balance transfer option (0% promo, etc.), it might make sense to consolidate some debts, then run snowball or avalanche on the resulting balance. (Be careful of fees and post-intro APRs.)

- Revisit your budget monthly: As debts drop, you may free up extra cash. Put that toward debt.

- Guard against “resetting” your habits: It’s tempting to slack off after one debt is paid — stay committed.

- Use visual tools: Charts, debt-progress trackers, or apps that show your “remaining debt snowball” can be very motivating.

- Celebrate milestones: Each debt paid is a win. Reward yourself modestly (without going into more debt).

- Adjust if needed: If you start with one method and find you’re losing steam, switch to the other. The aim is progress, not dogma.

- Protect yourself from emergencies: Before going all in, keep a small emergency fund (e.g. $500–$1,000) so unexpected expenses don’t derail the plan.

- Watch compounding & fees: Some debts have penalties, minimum interest clauses, compounding frequency, or late fees. Prioritize accordingly or negotiate if possible.

Key Takeaways

- Debt Snowball focuses on paying off the smallest balances first, giving you quick wins and motivation.

- Debt Avalanche targets the highest interest rates first, saving you the most money on interest over time.

- Studies show the snowball method can help people stick with debt payoff plans longer and pay off debts about 15% faster due to the psychological boost.

- Avalanche is mathematically more efficient, often reducing total interest and time in repayment.

- There’s no universal “best” method — the right choice depends on your personality, financial situation, and what motivates you most.

- You can even combine the two: start with snowball for momentum, then switch to avalanche for efficiency.

- The most important factor is consistency — whichever method you choose, stick with it until you’re debt-free.

Final Thoughts: Which Method Is “Right” for You?

Here’s the key: there’s no one-size-fits-all best strategy. What matters most is selecting a method you can stick with, one that fits your personality and finances, and consistently executing it until debt is gone.

- If you thrive on quick wins and need the motivation of seeing progress, Debt Snowball might be your best friend.

- If you hate paying interest and are disciplined enough to stay with it even when progress feels slow, Debt Avalanche might save you more in the long run.

- And if you want the best of both worlds, consider a hybrid: start with snowball to get momentum, then pivot to avalanche when the big debts remain.

No matter which path you choose, taking action is what matters. Every dollar you move toward debt reduction is a dollar not being wasted in interest. You may find surprises along the way — better-than-expected progress, extra cash to throw at debt, or shifting your mindset from “debt burden” to “debt control.”

You’ve already taken the first step: learning your options. Now, commit to the one that makes sense for you — and don’t look back. You’ve got this.

Frequently Asked Questions (FAQ)

1. Do I need to pay off all debt before saving or investing?

Not necessarily. High-interest debt, like credit cards, should be the top priority since those rates often outpace investment returns. For lower-interest debt, many people use a hybrid approach — paying it down steadily while still building an emergency fund or contributing to retirement savings.

2. Should I focus on credit cards first or loans like student debt?

It depends on the interest rates. Credit cards usually carry much higher APRs (often 20%+), so they should come first under the avalanche method. If your student loans are lower interest, they may move down the list unless they’re your smallest balance and you’re using the snowball approach.

3. What if I don’t have enough money to pay off debt?

Start small. Always cover minimum payments to avoid fees, then look for ways to free up even $20–$50 a month to put toward your target debt. Small amounts add up when combined with consistency. You can also explore side hustles, cut back on non-essentials, or consider debt consolidation if interest rates are overwhelming.

👉 For practical ideas, check out our guide on 10 Easy Side Hustles You Can Start This Weekend With $0 and our list of 75 Frugal Living Tips That Actually Work (Save Money Without Feeling Deprived).

4. What happens if I can’t stick with my chosen method?

You’re not locked in. If avalanche feels too slow or snowball feels too costly, you can switch. The important thing is keeping momentum — every dollar paid toward debt gets you closer to freedom, no matter which order you choose.

5. How do I stay motivated when progress feels slow?

Track your progress visually (apps, spreadsheets, or even a wall chart), celebrate each milestone, and remind yourself why you started. Joining a community or finding accountability can also help keep you on track when motivation dips.