Managing money can feel overwhelming, especially when every paycheck seems to disappear before the month ends. Between bills, groceries, and unexpected expenses, budgeting often feels like a chore that only adds more stress. But what if there was a simple formula you could follow that works no matter your income, lifestyle, or financial goals?

That’s exactly where the 50/30/20 budget rule comes in. This straightforward money management method has been praised by financial experts, adopted by millions worldwide, and even recommended by U.S. Senator Elizabeth Warren in her book All Your Worth.

The best part? It’s stress-free. Instead of tracking every penny or juggling complicated spreadsheets, the 50/30/20 rule gives you an easy, flexible framework to guide your spending and saving habits.

In this guide, we’ll break down exactly how the rule works, why it’s effective, and how you can start using it today to take control of your money.

What Is the 50/30/20 Budget Rule?

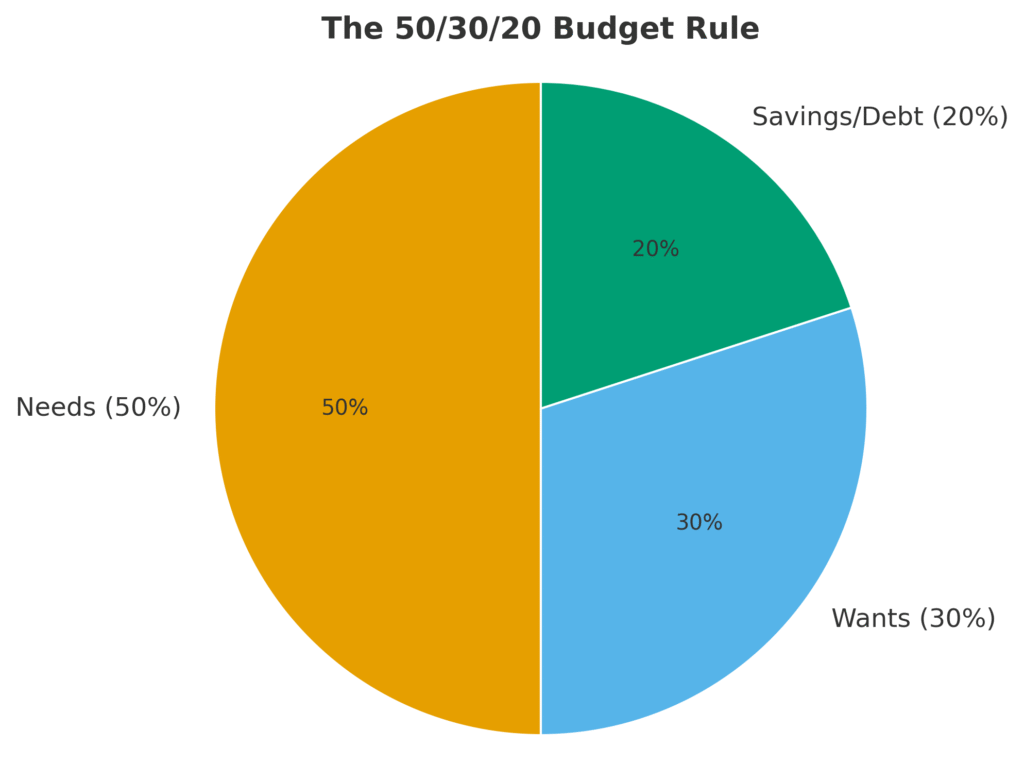

The 50/30/20 budget rule is a simple way to divide your after-tax income into three categories:

- 50% Needs – Essential living expenses

- 30% Wants – Lifestyle choices and fun spending

- 20% Savings & Debt Repayment – Building wealth and financial security

It’s popular because it’s straightforward, easy to remember, and flexible enough to adapt to different financial situations. Unlike strict zero-based budgeting or hyper-detailed tracking, the 50/30/20 method gives you a big-picture view of where your money should go—without feeling restrictive.

Why the 50/30/20 Rule Works

A lot of people give up on budgeting because it feels too complicated. But studies show that simplicity is one of the biggest factors in sticking to financial habits long-term. According to a 2023 survey by Bankrate, 74% of Americans live paycheck to paycheck at least once a year, and one of the main reasons is lack of financial planning.

Here’s why this method stands out:

- Balance Between Needs and Wants – It avoids the guilt many people feel when spending on fun by building lifestyle spending into the budget.

- Clear Savings Priority – By dedicating 20% to savings and debt payoff, you’re consistently building financial security.

- Flexible and Adaptable – Whether you make $30,000 or $130,000 a year, the percentages work the same.

Instead of overthinking money, you get a clear, actionable plan that makes progress automatic.

Breaking Down the 50/30/20 Rule

1. 50% – Needs

Half of your after-tax income should go toward essential living expenses. These are the non-negotiables that keep your life running smoothly:

- Rent or mortgage

- Utilities (electricity, water, gas, internet)

- Groceries

- Transportation (car payment, insurance, gas, public transit)

- Health insurance and medical costs

- Minimum debt payments

👉 Example: If your monthly take-home pay is $4,000, then $2,000 should be allocated to needs.

Pro Tip: If your needs are eating up more than 50%, it’s a signal to reassess. Can you refinance a loan, negotiate bills, or downsize? Small adjustments can have a big impact.

2. 30% – Wants

This is where the 50/30/20 rule shines compared to ultra-strict budgeting methods—it gives you permission to spend guilt-free. Wants are the non-essentials that make life enjoyable:

- Dining out

- Entertainment (movies, concerts, streaming subscriptions)

- Travel and vacations

- Shopping for clothes, gadgets, or hobbies

- Upgrades (choosing a nicer car or home than strictly necessary)

👉 Example: On a $4,000 income, you’d have $1,200 per month for wants.

Pro Tip: Be intentional. Just because you can spend the full 30% doesn’t mean you must. If your financial goals are aggressive (like paying off debt fast), you can shrink this category temporarily.

3. 20% – Savings and Debt Repayment

The final 20% is the most powerful part of the rule—it’s what builds long-term wealth and reduces financial stress. This money should go toward:

- Emergency fund contributions

- Retirement accounts (401(k), IRA)

- Extra debt payments (credit cards, student loans, personal loans)

- Investments (index funds, stocks, real estate)

👉 Example: From a $4,000 paycheck, $800 goes to savings and debt repayment.

Why it matters: A recent Federal Reserve survey revealed that 37% of Americans don’t have enough cash to cover a $400 emergency. Consistently saving 20% ensures you won’t be part of that statistic.

How to Start Using the 50/30/20 Rule

- Calculate Your After-Tax Income

Look at your pay stubs or bank deposits after taxes and deductions. This is your starting number. - Track Your Current Spending

Use a budgeting app (like YNAB or Empower) or simply check your bank statements to see where your money is going. - Categorize Your Expenses

Sort your spending into needs, wants, and savings/debt repayment. This helps you spot imbalances. - Adjust as Needed

If your needs exceed 50%, look for areas to cut back. If your wants are eating up savings money, shift the balance. - Automate Your Savings

Set up automatic transfers so the 20% savings portion is handled without you thinking about it.

Real-Life Example: Applying the Rule

Let’s say you bring home $3,500 per month after taxes:

- Needs (50%) = $1,750 → Rent ($1,000), Groceries ($400), Utilities ($200), Transportation ($150)

- Wants (30%) = $1,050 → Dining out ($300), Travel fund ($400), Shopping & entertainment ($350)

- Savings/Debt (20%) = $700 → Emergency fund ($300), Student loans ($200), Retirement account ($200)

With this plan, your bills are covered, you enjoy life, and you steadily build security.

Common Challenges and How to Overcome Them

1. High Cost of Living

If rent or housing takes up more than 50% of your income, you may need to adjust to something like a 60/20/20 budget until you can make changes.

2. Irregular Income

Freelancers or gig workers may struggle with fluctuating paychecks. The solution: base your budget on your average monthly income, and build a buffer fund for leaner months.

3. Large Debt Payments

If minimum payments alone exceed 20%, prioritize debt payoff first. This might temporarily reduce your “wants” category.

Why the 50/30/20 Rule Reduces Money Stress

Money is the #1 source of stress for Americans. In fact, a 2022 American Psychological Association survey found that 65% of adults cite money as a significant stressor.

The 50/30/20 rule reduces that stress by:

- Providing a clear structure (no guesswork about spending)

- Allowing guilt-free enjoyment (wants are built in)

- Ensuring steady progress toward financial goals

It turns budgeting from a burden into a straightforward system you can actually stick with.

Final Thoughts

The 50/30/20 budget rule is one of the easiest and most effective ways to take control of your finances. It balances the essentials, lifestyle enjoyment, and long-term goals in a way that feels sustainable.

Whether you’re just starting your financial journey or looking for a simpler way to manage money, this method can help you save more, stress less, and move closer to financial freedom.

The key isn’t perfection—it’s consistency. Start applying the rule to your next paycheck, and over time, you’ll see how powerful this simple formula can be.

Key Takeaways

- 50% Needs, 30% Wants, 20% Savings/Debt is the basic formula.

- It’s flexible and works for nearly any income level.

- Automating savings makes sticking to the rule effortless.

- It’s designed to reduce stress, not add to it.

Frequently Asked Questions (FAQ)

1. Does the 50/30/20 rule work if I have a low income?

Yes, but you may need to adjust. If your needs exceed 50%, aim for a modified version like 60/20/20 until your situation changes.

2. Should I use gross or net income?

Always use after-tax (net) income, since that’s what you actually take home.

3. What if I want to save more than 20%?

That’s fantastic! Many people aiming for early retirement or aggressive debt payoff save 30–40%. The rule is a guideline, not a limit.

4. How do I handle irregular income with this method?

Base your budget on your average monthly income, and build a buffer fund to cover lean months.

5. Is the 50/30/20 rule better than zero-based budgeting?

It depends. Zero-based budgeting is more detailed but requires more effort. The 50/30/20 rule is easier to stick with long-term, especially if you’re new to budgeting.

[…] For an in-depth guide on the 50/30/20 Rule, check out our blog post: The 50/30/20 Budget Rule: The Easiest Way To Manage Your Money Stress-Free. […]

[…] How is zero-based budgeting different from the 50/30/20 rule?50/30/20 uses broad buckets (needs/wants/savings), while ZBB assigns every dollar to a specific […]

[…] and Cash Flow: Use a simple system like the 50/30/20 rule (50% needs, 30% wants, 20% savings/investing) to get clarity on where your money goes. Knowing […]