Many people work hard but still struggle to see progress with their finances—usually because their money isn’t given a clear plan. Without a system, paychecks tend to disappear into bills, impulse purchases, and everyday expenses, leaving little behind for savings or debt payoff. That’s where zero-based budgeting (ZBB) comes in. By giving every dollar a specific job, this method helps you cut waste, stay focused, and move toward your financial goals with clarity and confidence.

Zero-based budgeting is a powerful money management strategy that forces you to be intentional with every single dollar. Instead of letting money “slip through the cracks,” you assign it to a specific purpose—whether that’s paying bills, building savings, or attacking debt.

In this guide, you’ll learn:

- What zero-based budgeting is (and how it differs from traditional budgeting).

- Why it’s effective for saving money, paying off debt, and reducing financial stress.

- Step-by-step instructions to set up your own zero-based budget.

- Common mistakes to avoid and tips to succeed.

Let’s dive in.

What Is Zero-Based Budgeting?

Zero-based budgeting is a method where your income minus expenses equals zero. Every dollar you earn is assigned to a category, leaving nothing “left over” without a job. Think of it as telling your money where to go instead of wondering where it went.

Traditional Budgeting Example

- Income: $4,000

- Expenses: $3,500

- Leftover: $500 (often unassigned and easily spent on impulse buys)

Zero-Based Budgeting Example

- Income: $4,000

- Expenses: $3,500

- Debt/Savings: $500

- Balance: $0 (every dollar is working for you)

With ZBB, you’re not literally spending every dollar—you’re directing it. If it doesn’t go toward bills or groceries, it goes toward savings, debt payments, investments, or a future goal.

Why Zero-Based Budgeting Works

Zero-based budgeting has been around for decades, but it’s grown in popularity because it directly tackles the biggest money struggles most people face. Here’s why it works so well:

- Eliminates wasteful spending – When money isn’t assigned a purpose, it often disappears into untracked purchases. ZBB makes sure every dollar is accounted for.

- Encourages intentionality – Instead of asking, “Can I afford this right now?” you’re thinking, “Does this align with my priorities?”

- Accelerates financial goals – Whether you’re building a $10,000 emergency fund or crushing credit card debt, ZBB helps you funnel extra dollars toward what matters most.

- Creates accountability – You’ll know exactly where your money went, not just where you think it went. This makes reviewing your budget more eye-opening.

- Reduces financial stress – Uncertainty is stressful. ZBB provides a clear plan so you can stop second-guessing your spending.

💡 Example: If you get a $1,000 tax refund, traditional budgeting might let it drift away on random purchases. With ZBB, that $1,000 could be split into $600 toward debt, $300 into savings, and $100 into fun money—every dollar has an intentional role.

How to Create a Zero-Based Budget (Step-by-Step)

Setting up your first zero-based budget takes a bit of time, but once it’s in place, maintaining it gets easier.

Step 1: Calculate Your Monthly Income

Start with your net income (the amount you actually bring home after taxes). Include all consistent sources:

- Salary or wages

- Side hustles or freelance income

- Rental property earnings

- Business revenue (after expenses)

If your income varies, base your plan on your lowest reliable month.

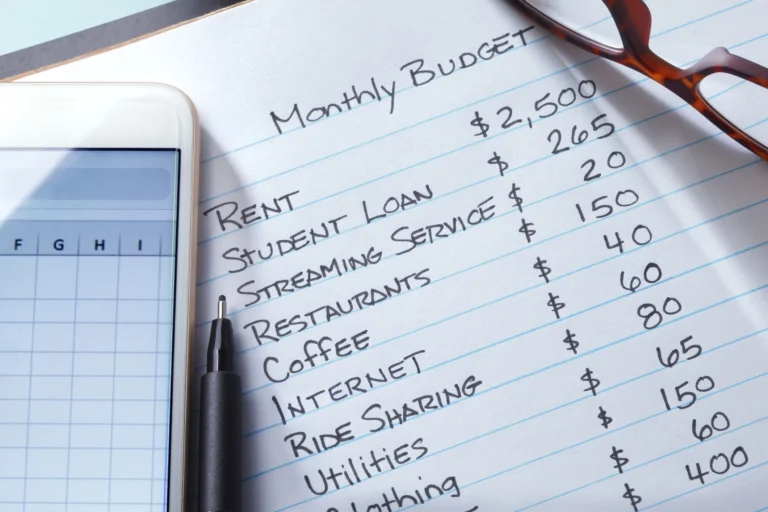

Step 2: List All Monthly Expenses

Capture both fixed and variable expenses, and don’t forget about irregular but predictable costs like car repairs or annual insurance premiums (divide them by 12 to get a monthly average).

Fixed Expenses (stable each month):

- Rent or mortgage

- Car payment

- Insurance premiums

- Subscriptions

Variable Expenses (fluctuate monthly):

- Groceries

- Utilities

- Transportation (gas, rideshare, public transit)

- Dining out

- Entertainment

Step 3: Assign Every Dollar a Job

Now comes the key step—every dollar needs a category. Essentials come first, then savings, then discretionary spending.

Example Zero-Based Budget (Income: $4,000)

| Category | Amount |

|---|---|

| Rent/Mortgage | $1,200 |

| Groceries | $400 |

| Utilities | $150 |

| Car Payment | $300 |

| Debt Repayment | $500 |

| Emergency Fund | $200 |

| Entertainment | $100 |

| Savings/Investing | $1,150 |

| Total Leftover | $0 |

Step 4: Track and Adjust

Budgets aren’t “set it and forget it.” They’re living documents. Track spending with tools like:

- YNAB (You Need A Budget): Built for ZBB specifically.

- EveryDollar: User-friendly app from Dave Ramsey’s team.

- Spreadsheets: Great if you prefer customization.

Review weekly, shift money between categories if needed, and make small corrections before things spiral.

Tips for Success with Zero-Based Budgeting

✅ Start with a buffer – Before going all-in, keep $500–$1,000 aside for unexpected costs. It prevents emergencies from derailing your budget.

✅ Be realistic – Cutting all “fun” spending backfires. Allow space for dining out, hobbies, or small luxuries so you don’t feel deprived.

✅ Try cash envelopes – For categories where overspending is easy (like groceries or entertainment), withdraw cash and stop spending when the envelope is empty.

✅ Automate bills and savings – Setting up autopay ensures bills are covered and savings actually happen without relying on willpower.

✅ Review monthly – Life changes. Adjust categories when expenses shift, like after moving or a new job.

Common Challenges (and How to Fix Them)

1) Irregular income

- Solution: Base your budget on your lowest earning month. Save surplus from higher-income months to cover lean periods.

2) Overspending in a category

- Solution: Move money from lower-priority categories immediately (e.g., shift from “entertainment” to “groceries”). Then, adjust future budgets to reflect reality.

3) Feeling restricted

- Solution: Include a “fun money” category, even if small. Set mini-rewards (like a $20 splurge) when you hit savings or debt milestones.

Zero-Based Budgeting vs. Traditional Budgeting

| Feature | Traditional Budget | Zero-Based Budget |

|---|---|---|

| Leftover Funds | Often unassigned | Always allocated |

| Goal Focus | Loose | Goal-driven |

| Flexibility | Moderate | High (reallocate anytime) |

| Best For | General tracking | Debt payoff, saving, control |

Traditional budgets give you a snapshot, but ZBB acts like a detailed roadmap. If you want to build wealth faster, ZBB’s structure is hard to beat.

Final Thoughts

Zero-based budgeting is more than a spreadsheet—it’s a mindset shift. When every dollar has a job, you stop letting money slip away unnoticed and start directing it toward the things that matter most. Instead of feeling like your finances are out of control, you’ll know exactly where your money is going each month.

This clarity not only reduces stress but also builds momentum. Whether your goal is to pay off debt, save for a home, or grow your investments, zero-based budgeting creates a clear roadmap to get there faster.

Remember, it’s not about perfection—it’s about progress. Some months will require adjustments, and that’s okay. The power of ZBB lies in its flexibility and intentionality, helping you stay focused even when life changes.

👉 Ready to take charge of your money? Start with your next paycheck and give every dollar a job—you’ll be amazed at how quickly the results add up.

Frequently Asked Questions (FAQs) About Zero-Based Budgeting

1. Is zero-based budgeting good for beginners?

Yes. Because it assigns every dollar a purpose, it’s one of the clearest ways to start understanding your spending habits and building new financial routines.

2. How is zero-based budgeting different from the 50/30/20 rule?

The 50/30/20 rule groups money into broad buckets: 50% needs, 30% wants, 20% savings. Zero-based budgeting is more detailed—every dollar gets a specific category.

3. Do I need a special app to do this?

Not at all. While apps like YNAB and EveryDollar make it easier, you can succeed with a spreadsheet or even pen and paper. What matters is consistency, not the tool.

4. What if my income changes month to month?

Base your plan on your lowest reliable income. Then, put any extra money into a “buffer” category. This prevents surprises when your earnings fluctuate.

5. Does zero-based budgeting mean I can’t have fun?

Absolutely not. The key is intentional fun. Instead of random splurges, you set aside a specific amount each month for guilt-free enjoyment.

6. How long does it take to see results?

Many people notice progress within the first month. By three to six months, most find themselves saving more, paying down debt faster, and feeling more in control.

7. Should I budget with a partner or spouse?

Yes. Review the plan together at least once a month. To avoid friction, give each partner a small “no-questions-asked” allowance for personal spending.

[…] most popular budgeting apps for beginners who want to take control of their money. It uses the “zero-based budgeting” method, meaning every dollar is assigned a purpose — whether it’s for bills, savings, or […]

[…] Is the 50/30/20 rule better than zero-based budgeting?It depends. Zero-based budgeting is more detailed but requires more effort. The 50/30/20 rule is easier to stick with long-term, […]